Kuala Lumpur 12 May The property market in Malaysia saw an improvement in 2019 with increased in transaction by 48 in volume and with only 08 increase in value indicating more transaction at lower prices. Perhaps the clearest indicator of market sentiment is seen in pricing movements moving into 2020.

Us House Prices Growth Economic Indicators Ceic

The good news for owners and investors is that new supply will fall from 2019 onwards.

. Stamp duties for property transfers worth more than RM1mil will be raised by 1. The value of all types of property transactions increased 51 in 1Q 2019 from 1Q2018 to about RM369 billion while the volume of transactions had risen by 69 in 1Q. According to the latest 2019 budget.

In Q3 2019 the GDP growth was still not impressive and at 44. The majority of these were completed in 2017-2018 and this supply is still in the process of absorption today. While the data published by NAPIC indicated a slight increase of 4 in residential property transaction volume the average transacted price for the residential segments saw a slight drop of 3 in Q1-Q3.

Property market recorded a marginal improvement. JPPH Malaysia will continue to monitor and evaluate the expected impact of the pandemic on the Malaysian property market and provide advisory to the government in ensuring that the market remains sustainable it said in conjunction with the launch of nine reports including Malaysia Property Market 2019. Sectoral market activity performance improved marginally.

Overall the property market looks to be stabilising as we move into 2022 following the disruptive impact of the COVID-19 crisis. Is the property market in Malaysia going to get better or deteriorate in 2020. There is little need to guesstimate.

Residential commercial industrial and agricultural reported some improvement while transactions for development land declined. Market activity in the first quarter of 2019 has also shown an improvement compared with the same period last year based on the volume and value of property transactions recorded. All the numbers below are official numbers from NAPIC.

According to the National Real Estate Information Center Malaysias NAPIC first-quarter survey the volume of transactions in Malaysias 2019 has increasedComparing to 2018 the real estate transactions in 2019 improved 08 in the first. A total of 328647 transactions worth RM14140 billion were recorded showing an increase of 48 in volume and 08 in value compared to 2018 which recorded 313710 transactions worth RM14033 billion. The fast-paced program is the quintessential market close show leading up.

The only market winner in Asia is so far Vietnam predicted to grow by 29 in 2020. The department released nine reports today including the Property Market Report 2019 PMR 2019 which showed that sectoral market. Malaysias property paradox may be coming to an end as developers build fewer homes.

Companies non-citizens and non-PR holders real property gains tax will be increased from 5 to 10. While for citizens and those with PR real property gains tax will be increased from 0 to 5 even after the first 5 years. Most property projects throughout Johor Bahru City Center Danga Bay Medini and Puteri Harbour will have completed by mid 2019.

Malaysia Property market transactions for 1H 2020 has dropped tremendously versus 1H 2019. It is widely agreed that the lack of up. Malaysia Property Market Outlook Q4 2019 The property market has been one of the most talked-about industries in Malaysia.

According to the PropertyGuru Market Index PMI Q3 2019 asking prices for properties across the board declined in three out of four major markets in Malaysia namely Kuala Lumpur Selangor and Penang. Looking at 2020 the economy is expected to contract by -45 putting the state in an even worse position. It was another slow year for Penang housing market in 2018 with no significant improvement in market sentiment.

Property Market 2019. Malaysia Property Market. Penang Property Outlook 2019.

The Malaysian property market saw marginal improvement in 2019 with the volume and value of transactions up by 48 and 08 respectively said the Valuation and Property Services Department Malaysia JPPH. Between Q2 2020 and Q2 2021 sharp drops in transactional activity were brought by rising infection rates and government-imposed movement restrictions resulted in price depressions and fluctuating supply volume. Buying property has been too expensive for many Malaysians.

Over the past ten years property development in and around Kuala Lumpur has grown rapidly without any large-scale consumer research being conducted to gauge the market demand. The year-on-year y-o-y residential overhang in Malaysia increased to 32313 units valued at RM1986bil in 2018 an increase of 306 in volume and 27 in value with High-rise units formed the bulk of the overhang units representing 434 of the total Wheres for the commercial sector the shop overhang situation recorded an increase of 112.

China House Prices Growth Economic Indicators Ceic

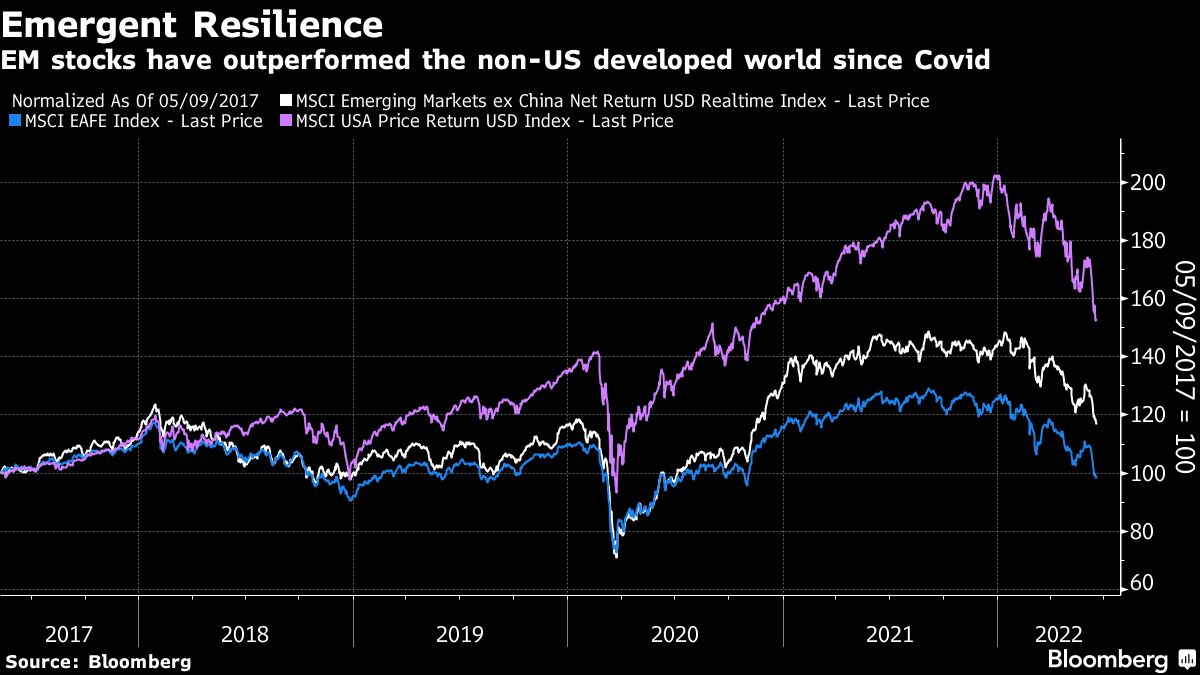

Property Is The Crisis Risk To Watch As Stocks Enter Bear Market Bloomberg

What Ails The Malaysian Residential Property Sector The Edge Markets

Investment Analysis Of South African Real Estate Market

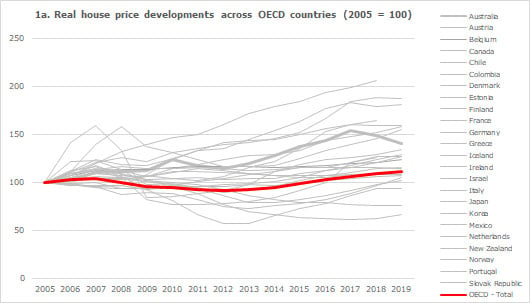

Statistical Insights Location Location Location House Price Developments Across And Within Oecd Countries Oecd

Property In Malaysia Malaysian Real Estate Investment

What Ails The Malaysian Residential Property Sector The Edge Markets

What Ails The Malaysian Residential Property Sector The Edge Markets

Property In Malaysia Malaysian Real Estate Investment

Most Expensive Housing Markets Globally 2020 Statista

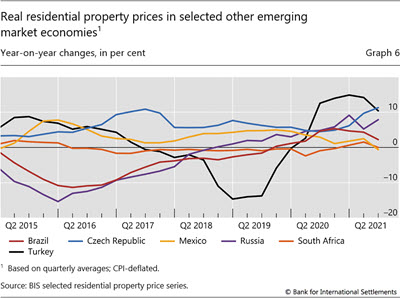

Bis Residential Property Price Statistics Q2 2021

Property In Malaysia Malaysian Real Estate Investment

What Ails The Malaysian Residential Property Sector The Edge Markets

Property In Malaysia Malaysian Real Estate Investment

Opportunities In A Stagnant Market In 2019 The Edge Markets

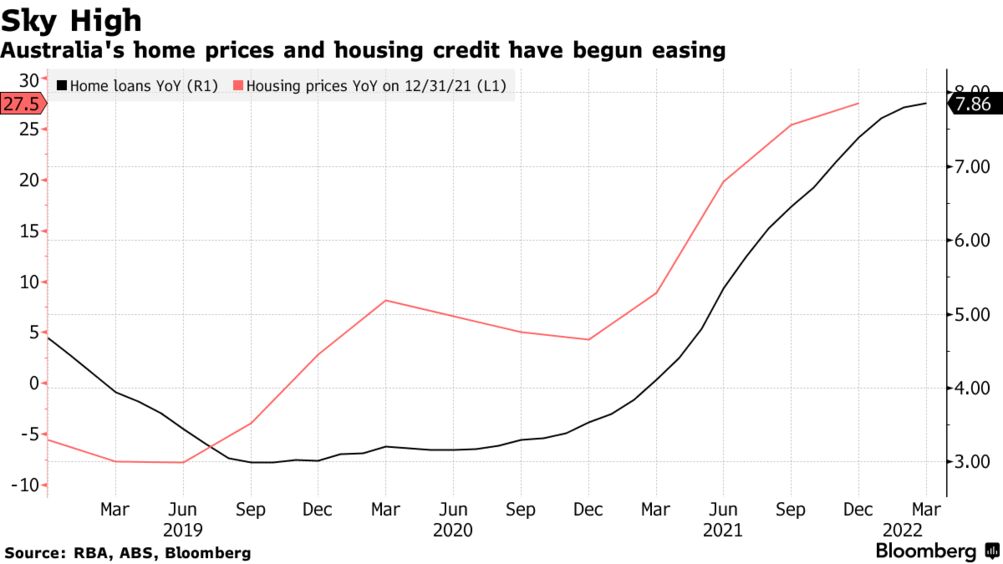

Australia Real Estate Cooling Property Market To Challenge Election Winner Bloomberg

Investment Analysis Of Hong Kong Real Estate Market

What Ails The Malaysian Residential Property Sector The Edge Markets

Bis Residential Property Price Statistics Q2 2021